CLIENT UPDATE

Competition & antitrust developments – looking back on 2023 and ahead to 2024

PUBLISHED DATE

FEB 04, 2024

CONTENT

- No sections yet

Overview

Soemadipradja & Taher (S&T)’s competition and antitrust law practice presents an overview of Indonesia’s antitrust & competition developments in 2023 and explores some of the trends as we move into 2024.

In this client update we explore the following key areas in the Indonesian competition and antitrust sphere:

- Competition & antitrust legislation

- Summary of main competition & antitrust cases

- Notification filings

- Competition compliance programs

- Outlook for 2024: Changes in leadership and KPPU’s priorities

Competition and antitrust legislation

In 2023, the Indonesian Government and the Indonesia Competition Commission (Komisi Pengawas Persaingan Usaha, KPPU) passed significant legislation that:

- has impacted the methods, calculations and procedures for handling competition cases;

- accommodates business activity development and its concern for information and data privacy.

We set out below the frequency of new KPPU regulations issued for the past three years, indicating a significant increase in KPPU regulatory activities over the past two years:

- 2021 – 5

- 2022 – 12

- 2023 – 13

The following law and regulations had the most significant impact on Indonesia’s competition framework in 2023.

No. | Regulation | Note |

|---|---|---|

Law 6 of 2023 |

| |

KPPU Reg 2 of 2023 |

| |

KPPU Reg 3 of 2023 |

|

Summary of main antitrust and competition cases

During 2023, KPPU examined and determined a wide range of cases involving alleged competition violations. Various final and binding decisions were also handed down by the Supreme Court of Indonesia (Supreme Court) relating to cases that had been examined in previous years. We set out short summaries of all these cases below (15 in total).

- Prohibited partnership: KPPU fined PT Aburahmi Rp2.5 billion for violating Article 35(1) of Law 20 of 2008 regarding Micro, Small and Medium Enterprises (MSME Law). PT Aburahmi was also ordered to amend the relevant partnership agreement and return certain disputed land (as part of the settlement).

- Prohibited partnership: KPPU closed Case No.01/KPPU-K/2023 concerning a partnership between PT Shopee International Indonesia (Shopee) and Shopee’s drivers, which was in violation of Article 35 paragraph (1) of the MSME Law, by ordering Shopee to take necessary actions to resolve the issue (that were subsequently fulfilled).

- Prohibited partnership: KPPU closed Case No.03/KPPU-K/2022 between PT Agri Eastborneo Kencana (PT AEK) and Koperasi Bina Tani Sawit Sedulang which was in violation of Article 35(1) of the MSME Law, by ordering PT AEK to revoke certain articles in the relevant cooperation agreement (that were subsequently fulfilled).

- Prohibited partnership: KPPU closed Case No.10/KPPU-K/2022 between PT Perkebunan Nusantara V (PTPN V) and Koperasi Sawit Makmur (KSM) by taking necessary actions concerning its cooperation with KSM.

- Prohibited partnership: KPPU closed Case No.07/KPPU-2/2022 concerning a partnership between PT Perdana Intisawit Perkasa (PT PISP) and Koperasi Sawit Bunga Idaman, which was in violation of Article 35(1) of the MSME Law, by ordering PT PISP to take necessary actions to resolve the issue (that were subsequently fulfilled).

- Bid-Rigging: KPPU fined PT Len Industri (Persero) and PT Len Railway Systems a total of Rp10.973 billion for bid-rigging of the procurement of the Double Track Electric Signaling Construction Project.

- Bid Rigging: KPPU fined four companies engaged in bid-rigging for the procurement of the improvement of the Peureulak- Lokop-Batas Gayo Lues Segmen 3 Road in the province of Aceh, a total of Rp5.4 billion. The four companies included (i) PT Wanita Mandiri Perkasa, (ii) PT Tamiang Karya, (iii) PT Andestmont Sakti, and (iv) PT Galih Medan Perkasa

- Bid-Rigging: KPPU fined PT Pembangunan Perumahan (Persero) Tbk., and PT Jaya Konstruksi Manggala Pratama Tbk., Rp16.8 billion and Rp. 11.2 billion respectively for bid-rigging relating to the procurement of the revitalisation of the Taman Ismail Marzuki Project.

- Bid Rigging: The Supreme Court granted a cassation (appeal) request by KPPU against a decision made by the Surabaya District Court. The District Court decision had previously annulled KPPU’s decision to impose a fine concerning violations of Article 22 of the Competition Law for conspiracy in relation to PT Cipta Karya Multi Teknik and prohibited three other parties from participating in any procurement sourced from the state or regional budget.

- Bid-Rigging: KPPU fined Mr. Lai Bui Min Rp1.5 billion for engaging in bid-rigging with PT Lambok Ulina and PT Tureloto Battu Indah for the procurement of improvements to the Kandang Roda-Pakansari Road Project. In addition, the companies were not allowed to participate in the procurement of goods and/or services sourced from the state or regional budget.

- Share Acquisition Notification: KPPU fined Pon Holdings B.V. Rp1.25 billion (approximately US$80,500) for delayed notification (by one working day) of its share acquisition of Dorel Finance US Inc.

- Share Acquisition Notification: KPPU fined Pon Holdings B.V. Rp1.25 billion (approximately US$80,500) for delayed notification (by one working day) of its share acquisition of Dorel Finance US Inc.

- Share Acquisition Notification: KPPU fined Nippo Corporation Rp1 billion Rupiah (approx. US$96,400) for delayed notification (by 35 working days) of its acquisition of PT Kadi Indonesia Manufaktur

- Market Dominance: KPPU fined the following seven companies engaged in

selling packaged cooking oil, a total of Rp71.280 billion for violating Article 19(c) of the Competition Law for activities between October-December 2021:

- PT Asianagro Agungjaya

- PT Batara Elok Semesta Terpadu

- PT Incasi Raya

- PT Salim Invomas Pratama

- PT Budi Nabati Perkasa

- PT Multimas Nabati Asahan

- PT Sinar Alam Permai

- Fixing, Exclusive Agreement and Market Dominance – KPPU closed Case No.11/KPPU-L/2023 concerning violations

by PT Kobe Boga Utama (KOBE) with its distributor. KOBE was able to execute a Change in Behaviour Integrity Pact (a set of specific undertakings), which was obeyed, under KPPU’s close supervision

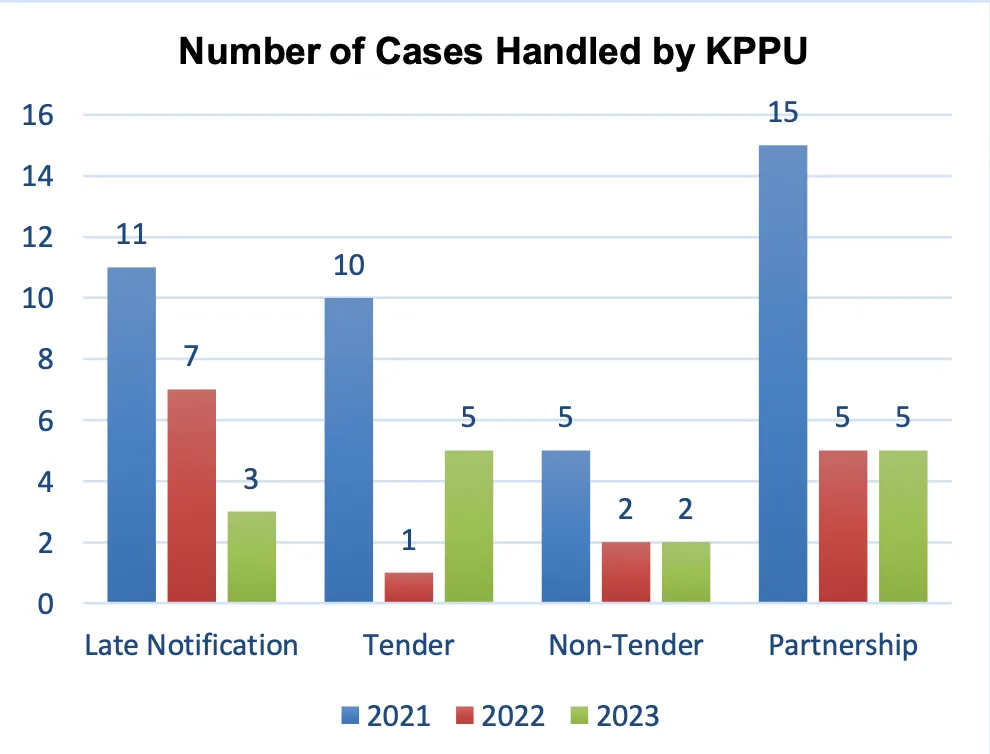

During 2023, KPPU examined 15 business competition cases consisting of five tender cases, five partnership cases, three late notification cases, one market dominance case and one case concerning price fixing, market dominance and exclusive agreement.

These cases also included cases that were closed by KPPU due to changes in agreed behavior and actions of those that had been reported.

Notification filings - for mergers, acquisitions and/or consolidations

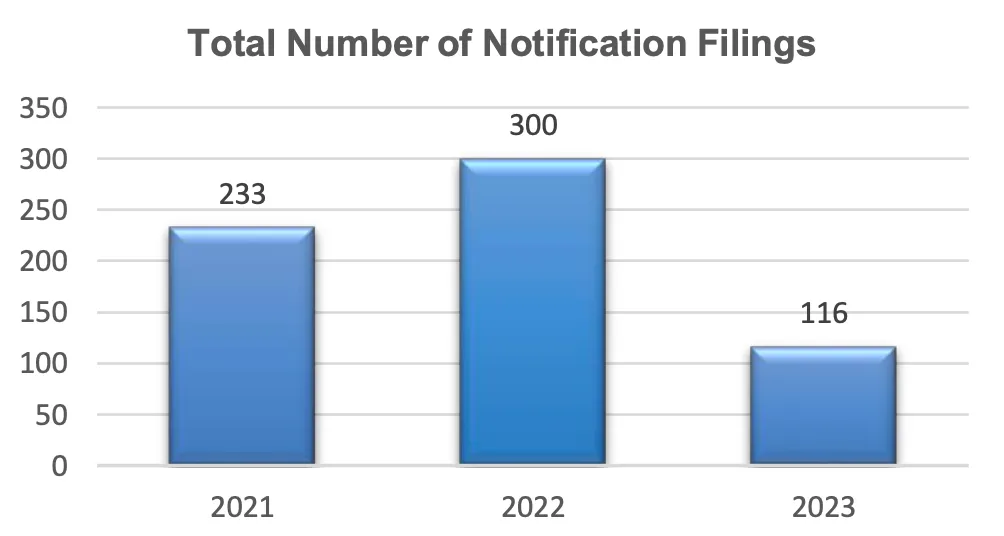

There was a significant decrease in the number of notifications filed with KPPU in 2023, with only 116 notifications made (compared to 300 in 2022). 1 Among the 2023 notifications, only 63 were made after the enactment of KPPU Reg No. 3 of 2023 (on 31 March 2023).

According to the KPPU Commissioner (2018-2023), Mr. Chandra Setiawan, the reason for such a decrease in notifications was due to improvements in economic conditions as the COVID-19 pandemic was nearing its end. This in turn created better company cashflows, resulting in less merger and acquisition activity in the market. 2

Competition compliance programs

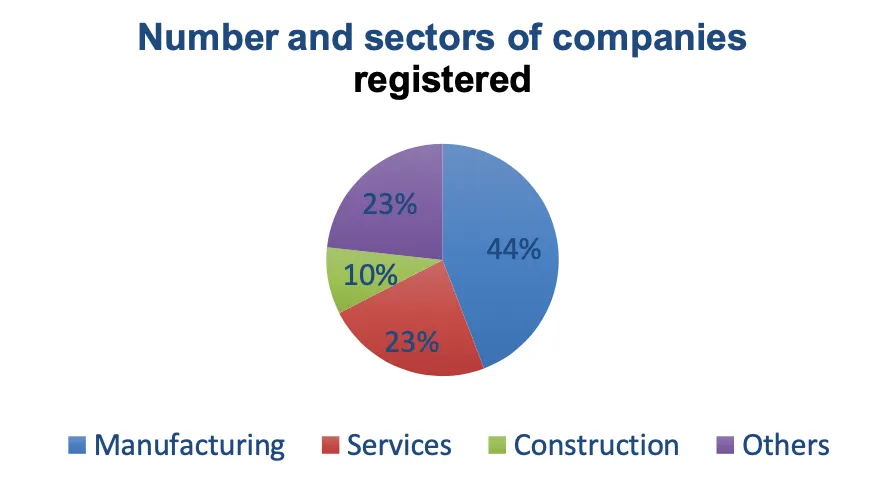

Since the issuance of KPPU Reg No.1 of 2022, the number of companies that registered for a competition compliance program (Compliance Program) now totals 43. In 2023, KPPU approved 14 Compliance Programs for companies from various sectors. The statistics of companies registered for Compliance Programs up to the end of 2023 are set out below:

Among the companies registered, 72% are state-owned enterprises while the rest are private companies. More importantly, 80% of those that applied did so voluntarily, while the rest did so in response to a recommendation arising out of a dispute.3 The intended purpose of the Compliance Program is to prevent companies from engaging in prohibited business competition activities, while also possibly granting relief from penalties if a violation were to be committed in the futur

Outlook for 2024: Change in leadership and priorities for KPPU

At the end of 2023, the Indonesian Parliament (Dewan Perwakilan Rakyat, DPR) nominated nine candidates to be part of KPPU’s new leadership (after passing the Parliament’s fit and proper test). These nine members will serve for the period 2024-2029, after they have been officially appointed by the President.

In light of this change in leadership, there are raised expectations that KPPU’s organizational structure will be improved and that competition regulation and management will be enhanced. We set out below a number of key areas to watch in the competition and antitrust space during 2024.

- Strengthening KPPU’s authority

The DPR has agreed to increase KPPU’s budget ceiling for the purpose of creating more programs and supporting KPPU’s management for more effective competition law implementation.4 KPPU has affirmed that it will need to strengthen its authority to be able to carry out more effective investigations. As noted in a study from the Handbook on Competition Law and Policy in ASEAN, KPPU is the only body in the ASEAN region without the authority to search for and seize documents for evidence.5 Therefore, it is hoped that such authority will be accorded to KPPU for better enforcement of the competition law.

- Leniency Program

One other prospective program is the “Leniency Program”, which hopes to eradicate cartel activities by providing leniency to business practitioners that independently and voluntarily report on such activities, serving as whistle blowers. If implemented, this program will be in line with similar programs applied in various countries such as Japan and Australia, which will show KPPU’s commitment to stay on trend with global practices.

- Anti-competition activities in the infrastructure sector

In terms of sectors, the main anti-competition concern is in the infrastructure sector. In November 2023, the Head of the KPPU Regional Office I advised the Regional Governments of North Sumatra to be vigilant in monitoring bid-rigging conspiracies among construction companies for procurement of road construction projects. As a result, 37 cases were reported in the region, some of which are still being examined by KPPU in 2024. 6

- Anti-competition activities in the digital market sector

Another KPPU focus is on the digital market, as Indonesia has one of the biggest economic digital markets, with predictions of it being valued at US$133 billion by 2025.7 As a result, KPPU hopes to encourage and work with the government to create legislation to even the playing field between major digital market players and Micro Small Medium Enterprises (MSMEs) that rely on digital platforms and to avoid abuse of bargaining power and anti-monopoly practices in general.8

- Anti-competition activities in the mining and electricity sector

KPPU’s new leadership has also announced that one of its goals for 2024 is to improve the mining and electricity sectors, as these two sectors have the lowest National Competition Index and have been below average the past five years. They aim to demonstrate concrete improvements in the mining and electricity sectors within the first 100 days after they have been officially appointed.9

- Specific concerns for 2024

A main concern KPPU intends to address in 2024 relates to partnerships between large companies and MSMEs, as there has been a trend for large companies to abuse the bargaining power they have over MSMEs. According to the KPPU Chairman, this abuse can be lessened by better KPPU supervision, better synergy and better coordination between KPPU and related ministries and agencies, such as the Ministry of Cooperatives and Small and Medium Enterprises (and related sectors). 10

According to KPPU, the poultry industry is also a main concern in 2024. Recognising the industry’s non-compliance with competition law principles, in late 2023 the KPPU Chairman formally communicated with the Minister of Agriculture suggesting various ways to improve poultry farming business compliance and to break up market concentration in the sector.11 The results of KPPU’s suggestions to the Ministry of Agriculture remain to be seen

PROFILE OF SOEMADIPRADJA & TAHER’S COMPETITION AND ANTI-TRUST PRACTICE

Soemadipradja & Taher (S&T)’s competition & anti-trust law practice group is one of the leading competition & anti-trust law practices in Indonesia. This practice group has an outstanding reputation advising on competition matters and regulatory compliance in Indonesia and is led by seasoned practitioners.

Our competition & anti-trust lawyers advise a wide range of national and multinational companies on matters relating to competition law, with key areas being:

- competition law advice, including matters relating to investigations of abuse of dominant position claims, tenders, procurement (i.e., bid rigging), cartels, and prohibited share ownership;

- competition litigation, including representing clients in proceedings at the KPPU, Indonesian commercial court, and the Supreme Court of the Republic of Indonesia;

- regulatory compliance, including competition compliance programs.

Our competition & anti-trust lawyers are highly knowledgeable individuals who have had a wealth of experience in dealing with the KPPU in matters involving cases of alleged infractions against competition law and regulations and are proficient at communicating in English and Bahasa Indonesia.

S&T also maintains relationships with a number of leading international and regional law firms including Allen & Gledhill (Singapore), Freshfields Bruckhaus Deringer (London), Nagashima, Ohno, Tsunematsu (Japan) and Corrs Chambers Westgarth (Australia).

As recognition of our expertise in the field of competition and antitrust law, S&T has been awarded by several legal directories including:

- Band 2 for Competition and Antitrust by Chambers & Partners;

- Band 2 for Antitrust and Competition by Legal 500;

- Top 100 Indonesian Law Firms 2023 by Hukum Online

- Hukum Online Practice Leaders 2023

References

01

https://www.antaranews.com/berita/3855201/kppu-catat-tren-merger-dan-akuisisi-perusahaan-turun-pada- 2023#:~:text=%E2%80%8B%E2%80%8B%E2%80%8B%E2%80%8B%E2%80%8B,dan%20akuisisi%20pada%20tahun%202022.

02

https://www.antaranews.com/berita/3855201/kppu-catat-tren-merger-dan-akuisisi-perusahaan-turun-pada-2023

03

https://www.antaranews.com/berita/3764481/kppu-mencatat-43-perusahaan-daftar-program-kepatuhan-persaingan-usaha

04

https://kppu.go.id/blog/2023/09/kppu-bahas-rka-k-l-ta-2024-bersama-dpr-ri/

05

https://kppu.go.id/wp-content/uploads/2023/01/Siaran-Pers-No.-01_KPPU-PR_I_2023.pdf

06

https://www.antaranews.com/berita/3843552/kppu-waspadai-persekongkolan-tender-jasa-konstruksi-di-sumut

07

https://kppu.go.id/wp-content/uploads/2021/01/Ek.-Digital-2020-Ringkasan-Eksekutif.pdf

08

https://www.hukumonline.com/berita/a/kppu-kemenkopukm-tekankan-pentingnya-uu-pasar-digital-lt653b316ee9070/

09

https://setkab.go.id/ketua-kppu-tegaskan-fokus-pada-sektor-di-bawah-rata-rata-indeks-persaingan-usaha-nasional-di-bawah/

10

https://kppu.go.id/blog/2023/05/kemitraan-umkm-masih-bermasalah-kppu-nilai-sinergi-dan-koordinasi-kelembagaan-dibutuhkan/

11

https://kppu.go.id/wp-content/uploads/2023/12/Siaran-Pers-No.-65_KPPU_PR_XII_2023.pdf

AUTHORED BY