CLIENT UPDATE

2024 recap and 2025 projections in competition & antitrust

PUBLISHED DATE

MAR 16, 2025

Overview

Soemadipradja & Taher (S&T)’s competition and antitrust law practice presents an overview of the developments which occurred in Indonesia’s competition and antitrust landscape in 2024 and explores some important trends, as we look ahead to 2025.

In this client update, we explore the following key matters in the field of competition and antitrust:

- Changes to the commission members of the Indonesia Competition Commission (Komisi Pengawas Persaingan Usaha, KPPU).

- Competition and antitrust legislation.

- Summary of the competition and antitrust cases decided in 2024.

- Notification fillings.

- Competition compliance programs.

- Outlook for 2025: KPPU’s main concerns and agenda.

Competition & antitrust trends in 2024 by numbers

We set out below several key statistics regarding Indonesia’s competition landscape in 2024:2

7 new regulations issued:

|

9 cases decided by KPPU, consisting of:

|

3 Supreme Court decisions on appeals against KPPU decisions |

149 notification filings |

4 companies obtained a competition compliance program approval following KPPU determination |

1 change of conduct following a violation of the 1999 Competition Law3 |

Changes to KPPU commission members

2024 was a pivotal year for KPPU, as it witnessed a complete restructuring of its commission members. For the first time, none of the incumbent commission members retained their positions in the new 2024-2029 term. The newly appointed commission members are:

- Mr. M. Fanshurullah Asa (Chairman of KPPU);

- Mr. Aru Armando (Vice Chairman of KPPU);

- Mr. Rhido Jusmadi;

- Mr. Gopprera Panggabean;

- Mr. Hilman Pujana;

- Mr. Moh. Noor Rofieq;

- Mr. Mohammad Reza;

- Ms. Eugenia Mardanugraha; and

- Mr. Budi Joyo Santoso.

Among the newly appointed members, five have had extensive careers within KPPU, while others are academics and professionals with substantial industry experience. This diversity will undoubtedly enhance KPPU’s capabilities, as the new commissioners bring first-hand experience to the application and enforcement of the 1999 Competition Law, as well as in-depth knowledge of key industries, particularly in the mining and oil & gas sectors. In recent years KPPU has focused on improving these sectors’ competition practices. 4

Competition and antitrust legislation

In 2024, KPPU introduced notable regulations that brought about updates to Indonesia’s competition law framework. These developments include:

- a comprehensive revision of KPPU’s organisational structure, which expands KPPU’s authority to include supervision of partnership agreements and stricter governance of accountability within KPPU; and

- a refined set of procedures for handling partnership cases between large businesses and micro, small, and medium enterprises (MSMEs).

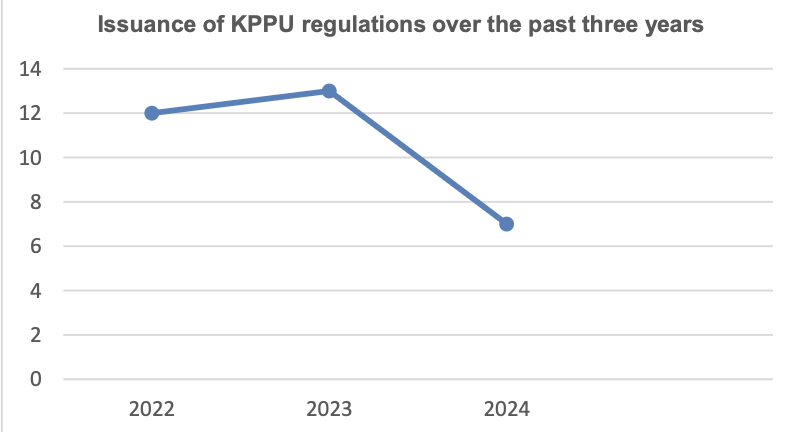

Notably, 2024 indicated a decrease in the number of regulations introduced by KPPU, signalling a slowdown in regulatory activity.

The following regulations introduced in 2024 have had the most impact on Indonesia’s 1999 Competition Law landscape:

No | Regulations | Note |

|---|---|---|

1. | Presidential Regulation No.100 of 2024 | This regulation:

|

2. | KPPU Regulation No.2 of 2024 | This regulation:

|

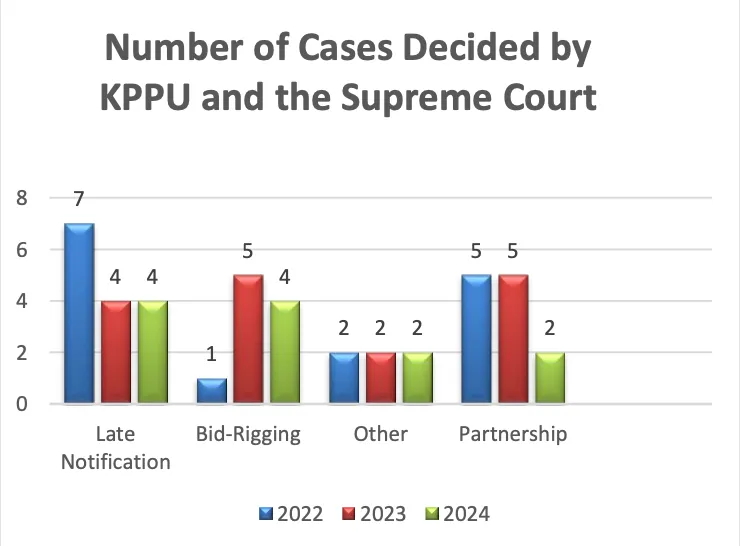

Summary of the main antirust and competition cases

During 2024, KPPU examined or determined a wide range of cases involving alleged competition violations. Not all decisions set out below are final and binding, as some are still on appeal. Several final and binding decisions were also handed down by the Supreme Court of Indonesia (Supreme Court) relating to competition cases that were decided by KPPU in earlier years.

We summarise below a number of the more significant cases decided in 2024.

- Bid rigging: KPPU fined PT Sumber Bangun Santosa Rp1.5 billion for bid rigging for the procurement of advanced construction works for the development of Nusa Penida seaport facilities. Other reported parties in this case were also prohibited from participating in any public procurement projects funded by the state budget for the next year.

- Bid rigging: KPPU fined PT Buana Prima Raya and PT Multi Teknindo Infotronika Rp1 billion and Rp28 billion, respectively for bid rigging for the procurement of the Cryo-Em, Transmission Electron Microscope (TEM) Room Temperature for Life Science and TEM for a Material Science tender. This is a significant case because the total value of the fines imposed on both parties together is the maximum fine that can be imposed on reported parties, considering the project’s contract value.

- Bid rigging: The Supreme Court upheld a KPPU decision in a bid rigging case involving PT Jakarta Propertindo (Perseroda), which was made in 2023 involving the revitalisation project for Gedung Kesenian Ismail Marzuki.

- Bid rigging: The Supreme Court overturned the Central Jakarta Commercial Court’s and KPPU's decision against PT Pembangunan Perumahan (Persero) and PT Jaya Konstruksi Manggala Pratama, Tbk for alleged bid rigging of the revitalisation project of the Gedung Kesenian Ismail Marzuki project. The court found no evidence of cooperation or conspiracy, dismissing the violation of Article 22 of the 1999 Competition Law.

- Dominant position and discrimination: KPPU determined that PT Shopee International Indonesia and PT Nusantara Ekspres Kilat upheld their commitment under the integrity pact on the change of conduct for discriminating against other couriers. As a result, KPPU closed case No.04/KPPU-I/2024.

- Price fixing: KPPU found the following three companies:

- PT Java Sarana Mitra Sejati;

- PT Masaji Tatanan Kontainer Indonesia; and

- PT Citra Prima Container.

who are all members of the Indonesian Container Depot Association in the Lampung area, guilty of determining the price of container depot services because they agreed on upper and lower tariff limits for such services, based on a letter drafted by the reported parties. The reported parties were ordered to stop their business activities referred to in the letter.

- Prohibited partnerships: The Supreme Court upheld the Central Jakarta Commercial Court's decision to overturn KPPU's ruling against PT Aburahmi for violating Article 35(1) of Law 20 of 2008 on MSMEs (as amended) (MSME Law) in its partnership with Koperasi Penukal Lestari, on the basis of KPPU's lack of on-field investigations and exceeding its authority.

- Prohibited partnerships: KPPU fined PT Hardaya Inti Plantations Rp1 billion for violating Article 35(1) of the MSME Law and ordered the company to amend several contracts entered into with Koperasi Tani Plasma Amanah.

- Share acquisition notifications: KPPU fined PT Bundamedik, Tbk, Rp5 billion (approx. US$308,000) for delayed notification (by 51 business days) of its share acquisition of PT Pintu Ilmu.

- Share acquisition notification: KPPU fined Toko Alpha Pte Ltd., Rp1 billion (approx. US$61,750) for delayed notification (by seven business days) of its share acquisition of PT Aset Digital Berkat.

- Share acquisition notifications: KPPU fined PT Tamaris Hidro Rp10 billion (approx. US$617,000) for delayed notification (by 149 business days) of its share acquisition of PT Sumber Baru Hydropower.

- Share acquisition notifications: KPPU fined PT Morula Indonesia Rp10 billion (approx. US$617,000) for delayed notification (by 54 business days) of its share acquisition of PT Medika Sejahtera Bersama.

Apart from the above, in a landmark case examined in 2024, KPPU found that Google LLC, had violated the anti-monopoly provisions and abused its dominant position. These violations resulted in KPPU imposing the largest fine ever imposed in the history of competition cases in Indonesia, amounting to IDR202.5 billion (approx. US$12.5 million).

KPPU decided 9 competition cases, while the Supreme Court rendered final and binding decisions on 3 competition cases.

Notification filings - for mergers, acquisitions and/or consolidations

A total of 149 notification fillings were made in 2024, which is a 2% increase from 2023 of 146 notifications. 5

Competition compliance programs

Thirteen companies registered for a competition compliance program this year, bringing the total to 56 since KPPU Regulation 2/2022 was issued. Among these companies, 35 are state-owned enterprises (SOEs) and 21 are national and multinational private companies. A majority of these companies (88%) registered voluntarily, while the rest did so in response to a recommendation arising out of a dispute. Furthermore, 20 of these companies have received compliance programme determinations following KPPU approval. 6

KPPU continues to encourage companies to register for competition compliance programmes, as it is a way to boost the company’s credentials for good corporate governance. As such, this continues to be a priority for KPPU in 2025, particularly for SOEs. 7

Outlook for 2025: KPPU’s main concerns and agenda

Many programmes that were a priority for KPPU in 2024, continue to be a priority in 2025. and it is anticipated that the recent increase in their budget by approximately Rp420 billion for this fiscal year can help KPPU achieve its goal of fostering better business competition, mainly by:8 9

- amending the 1999 Competition Law;

- maintaining people's purchasing power;

- increasing the efficiency of the state budget (locally known as APBN) and Regional Budget (locally known as APBD) and sectors of concern;

- better supervising MSME partnerships; and

- better supervising the digital market.

We set out below our brief comments on each of the KPPU’s above goals.

- Amending the 1999 Competition Law : Amending the 1999 Competition Law has been on the KPPU’s agenda for a number of years, but will hopefully be achieved this year. The proposed amended law contemplates new provisions on extraterritorial matters, changes to merger control and pre-merger notifications, the addition of leniency programme arrangements, and increased KPPU authority for coercive measures in obtaining evidence and executing decisions.10

- Maintaining people’s purchasing power : To achieve this goal, KPPU intends to focus on maintaining reasonable prices for certain goods in certain sectors, including food, transportation ticket prices and commodities. One specific concern is the excessive prices of airline tickets and, even though there have been positive results in trying to reduce the prices (by 10%), KPPU believes more can be done to reduce prices by 30%. To do so, they intend to control the prices of jet aviation fuel, which plays a major role in determining the price of airline tickets.11

- Efficiency in APBN and APBD and sectors of concern : This matter relates to the significant incidences of bid rigging that occurs in procurement projects sourced from APBN or APBD. KPPU intends to be stricter with the imposition of monetary penalties if businesses are found to have been involved in bid rigging. Small steps were taken in 2024, as evident in the PT Buana Prima Raya and PT Multi Teknindo Infotronika cases, where KPPU imposed the maximum fine possible.12 KPPU also hopes to improve the competition index of certain sectors which, since 2024, continues to be low in Indonesia. These sectors include the energy, mining, water and waste management.13

- Better supervision of MSME partnerships : KPPU intends to better supervise MSME partnerships, as data shows that such partnerships contributes 61% of Indonesia’s gross domestic product.14 To do so, KPPU intends to work with various government agencies to create an information system that integrates Indonesian MSME data by focusing on such matters as legality, market access and financing. KPPU also intends to advise the Indonesian President to issue an instruction directed at large businesses to encourage partnering with MSMEs to increase economic growth and equality. The MSME Minister supports the need for partnerships because data shows that only 4% of Indonesian MSMEs are connected to global supply chains. In comparison with other Southeast Asian countries have much higher rates.15

- Better supervision of the digital market : The digital market is vital to Indonesia’s economy. KPPU has publicly indicated that it aims to collaborate with the government to create fair regulations, with the aims of ensuring a level playing field for MSMEs reliant on digital platforms and preventing abuse of power or monopolistic practices by major players. KPPU also hopes to better supervise the digital and MSME sectors, given the complexity of issues arising in those sectors. 16

References

01

The authors would like to thank Ilman Tobing and Nurfalaqy Rusdianto for their contributions to this update.

02

Presentation delivered by M. Fanshurullah Asa entitled “Keynote Speech- Ketua KPPU” for the Competition and Antitrust Outlook on 8 January 2025, https://kppu.go.id/penetapan/ and https://putusan.kppu.go.id/menu/.

03

Law No. 5 of 1999 Concerning the Prohibition of Monopolistic Practices and Unfair Business Competition

04

https://www.hukumonline.com/berita/a/target-100-hari-kerja--kppu-awasi-sektor-migas-hingga-pasar-digital-lt65b8ef57ee2b4/

05

Please refer to footnote No.2.

06

https://kppu.go.id/blog/2024/12/kppu-kementerian-bumn-bersinergi-kerahkan-bumn-dalam-program-kepatuhan-persaingan-usaha/ and https://www.antaranews.com/berita/3764481/kppu-mencatat-43-perusahaan-daftar-program-kepatuhan-persaingan-usaha

07

https://finance.detik.com/berita-ekonomi-bisnis/d-7682101/kppu-kementerian-bumn-sinergi-dalam-program-kepatuhan-persaingan-usaha

08

https://jdih.dpr.go.id/berita/detail/id/51302/t/javascript

09

https://surabaya.suaramerdeka.com/ekonomi/106114246612/akhir-tahun-kppu-target-tiga-prioritas-utama-pada-2025-2029

10

https://kppu.go.id/blog/2024/11/46465/

11

https://surabaya.suaramerdeka.com/ekonomi/106114246612/akhir-tahun-kppu-target-tiga-prioritas-utama-pada-2025

12

Please refer to footnote No.9.

13

YouTube Video: “Outlook Persaingan Usaha KPPU 2025” Uploaded by Komisi Pengawas Persaingan Usaha on 8 January 2025.

14

Presentation presented by M. Fanshurullah Asa entitled “Keynote Speech- Ketua KPPU” for the Competition and Antitrust Outlook on 8 January 2025.

15

https://kppu.go.id/blog/2024/12/kppu-kementerian-umkm-dan-berbagai-lembaga-bahas-kemitraan-umkm/

16

https://kppu.go.id/blog/2024/11/46465/

AUTHORED BY

-6.webp&w=3840&q=75)